The content of the financial promotions on this website has not been approved by an authorised person within the meaning of the Financial Services and Markets Act 2000. Reliance on these promotions for the purpose of engaging in investment activity may expose an individual to a significant risk of losing all of the property or assets invested.

Invest in the UK’s Assisted Living Property Market

The Assisted Living market in the UK is one of the most lucrative markets for people to invest in. In this market, the majority of properties receive higher rental yields with the addition of being protected by long-term government contracts and leases.

- Predicted 2.1 x multiple growth on capital invested

- Income generating from day 1

- 25-year rental guaranteed by government backed income

- Properties already built

- 25-year leases in place managed by FCA registered Yale housing association

Download brochure

Overview

The Assisted Living market in the UK offers potential investors the opportunity to receive higher returns while also benefiting the people who are in real need of Assisted Living accommodation. In addition, you would be helping to fulfil the shortage of these kinds of properties in the UK.

Residents in these properties not only have access to round-the-clock support, they can also receive coaching in life skills to increase their independence.

What is Assisted Living?

Assisted Living is a home that is created to support independent living for those with certain needs, whilst also providing on-hand support. Residents include, (but are not limited to) vulnerable adults, the elderly, people with mental health needs, disabled, those with complex needs, and people who have experienced homelessness. Assisted Living can be used by anyone who needs 24-hour assistance with the benefit of retaining their own self-contained space.

Residents in these properties not only have access to round-the-clock support, they can also receive coaching in life skills to increase their independence.

The problem

Assisted living accommodation has been encouraged by local authorities and health authorities in the UK since the late 1980s as a result of the drive to accelerate the closure of the long-stay inpatient hospitals for people with a learning disability and autism. Assisted living housing refers to accommodation that is specifically designed to meet the needs of elderly and disabled residents as well as those living with enduring illnesses, offering a range of support services and amenities to help them live independently.

A lack of such housing can lead to a range of negative outcomes and negatively impact people living with enduring illnesses. For instance, they may become more socially isolated, suffer further health complications, and need more expensive forms of care such as residential nursing homes. These potential outcomes highlight the need for greater investment in assisted living properties to ensure that these residents are receiving the care and support they need.

The solution

The objective of Assisted Living is to provide a stable and secure income stream for investors through the acquisition and leasing of properties to reputable housing CBSs (Community Benefit Societies).

The Assisted Living Project acquires properties comprised of multiple units that are leased to reputable housing CBSs and councils over 25 years on lease agreements that are government funded by the Department for Work and Pensions (DWP) and indexed to pay rental income at 1% above inflation. The housing community benefit societies fully manage, operate and occupy the properties on behalf of the Assisted Living Project.

Once the properties are leased to a housing CBS, the Assisted Living Project will look to replicate the process and own multiple assisted living properties leased to CBSs for a minimum of 25 years, with a view to then either list on a stock exchange, such as the London Stock Exchange, or sell the properties to large income funds.

Why Invest in the UK’s Assisted Living Property Market?

The assisted living property market is one of the most profitable markets for investors in the UK.

According to LaingBuisson’s Homecare and Supported Living UK Market Report, the 2021/22 market value in the UK for supported living was a huge £11.5bn, increasing by 9.1% in the 5 years prior to 2022.

The UK is currently experiencing a huge increase in demand for assisted living properties, offering a gap in the market for privately owned supported living sites to be let at higher rates on 25+ year leases to nationwide local authorities.

Whilst the initial cost of an assisted living property can be higher than that of a standard residential property in the same area, the rental yields on offer far outweigh properties sold on the residential property market. As demand for assisted living continues to grow, the returns will grow in line with this demand.

Assisted Living has become ever increasingly popular to investors due to the secure, impressive returns and government protected security whilst supporting assisted living services enabling people with a wide range of disabilities to live happy, independent and safe lives.

"A home is a fundamental human need. But right now, there are simply not enough good quality, low-cost homes available for everyone who needs one."

Shelter

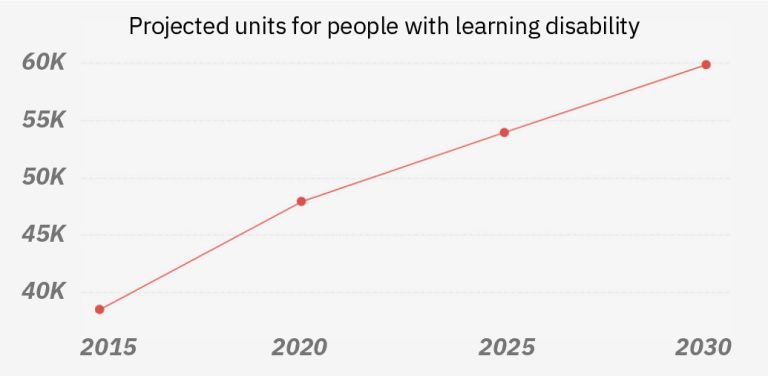

Projected demand for supported housing in Great Britain 2015 to 2030 commissioned by the Department of Health (DH), on behalf of the Department of Communities and Local Government (DCLG), from the Policy Research Unit in Economics of Health and Social Care Systems (at the University of York, LSE and University of Kent), PSSRU Discussion Paper DP2931 (Mar 2017). Projected units of supported housing by client group in England, 2015-2030 (Base case, in thousand units).

Key Benefits

Properties

already built

No maintenance

fees

Fully insured and repairing leases

Predicted 2.1x

multiple growth

25-year leases in place managed by

FCA registered Yale housing association

No void

periods

Income Generating

From Day 1

Inflation +1%

rental income

No construction or planning risk

25-year rental guaranteed by

government backed income

Is Assisted Living, as a Property Investment Profitable?

Assisted living property investment is a lucrative opportunity. Privately owned assisted living properties help to fulfil the shortage of available properties with government-backed income. The rental yields can be adjusted periodically to account for inflation and other economic factors which is another factor which makes this sector increasingly popular for investors.

The Process

1

2

3

4

Pipeline

The Raw Facts

£7.8 billion

£12.3 billion

1.2 million

145,000

New affordable homes needed each year to 2031 with the demand increasing

Download our brochure

CONTACT

Mayfair

London, W1J 5EN

Black Castle Capital Partners Ltd. Registered in England & Wales. Company registration number 10635644. Registered address: 48 Charles Street Mayfair London, W1J 5EN.

© 2025 Black Castle Capital Partners Ltd. All Rights Reserved.